Posts in category News & Events

Mercer County Community FCU Donates $2,500 to Junior Achievement

On June 17, 2025, Mercer County Community Federal Credit Union contributed $2,500 to Junior Achievement (JA) of Western PA in support of JA’s mission to inspire and prepare young people to succeed. With the help of this donation, JA programming can continue to provide valuable lessons to hundreds of students in schools throughout western PA that promote financial capability, work and career readiness, and business ownership.

In collaboration with JA, credit union staff members serve as volunteers to teach financial literacy lessons in local schools, attend career fairs, and take part in JA Biztown – a fully interactive simulated town where students learn about the business world. “Mercer County Community FCU is a proud supporter of financial literacy programs in our community,” stated Sandi Carangi, CEO of Mercer County Community FCU, “this donation helps ensure our students continue to receive JA lessons in our schools.”

For more information about Junior Achievement, visit www.westernpa.ja.org.

Mercer County Community FCU Hosts Ionta School Essentials Club Students

When Mercer County Community Federal Credit Union sponsored the first students from Mercer County to participate in the Junior Achievement of Western PA’s (JA) BizTown experience, they knew it would have a positive impact on the fifth graders. The students took that experience a step further, created their own store and visited the credit union, bringing it all to life.

The JA BizTown program starts with classroom lessons on personal economics and basic finances. Students then put those lessons into action when they spend a day at the JA BizTown facility in South Fayette Township, an interactive mock town that simulates the various roles in a thriving community and helps students learn the reality of the business world.

When the Ionta Elementary students from Hermitage School District returned from JA BizTown, they chose to take their experience even further by creating an in-school store where they would sell pens, pencils, erasers and other items. The Ionta Essentials Club, led by fifth grade teacher Mike Wilson, was formed and is now in its second year. Funds raised from the club are used to support future classes of Ionta students to attend JA BizTown.

In May, Mercer County Community FCU hosted students from the Ionta Elementary School’s Essentials Club for a field trip to the credit union. Students learned about careers at a credit union, practiced writing checks and counting money. The fifth graders also had an opportunity to share with credit union representatives what they learned by going to JA BizTown and operating their store.

Inviting students to visit the credit union and learn more about finances is just one of the many ways Mercer County Community FCU supports financial literacy in the community.

Don’t Tax My Credit Union

Don’t Tax My Credit Union – This is an important update that could affect you and the nearly 140 million credit union members across our country. Unlike for-profit banks, credit unions are not-for-profit financial cooperatives, meaning we don’t answer to corporate shareholders – we exist to serve you. Our federal tax-exempt status makes that possible. It allows us to reinvest in our members and communities in ways other financial institutions don’t – and is a model that has flourished for over a century.

Efforts to change the tax status of credit unions continue to move forward in Congress. If these proposed changes move forward, the consequences could be devastating. But together, we can make a difference. Learn more & take action here!

Mercer County Community FCU Awards Scholarships to Area Students

Mercer County Community Federal Credit Union celebrated 68 years of service to its members at their Annual Meeting held on April 12, 2025. Sandi Carangi, CEO, reported that over the past year the credit union opened its new office in Hermitage, added new services to support the financial needs of its growing membership, and donated thousands of dollars to non-profit organizations in the community carrying out the credit union philosophy of “People Helping People.”

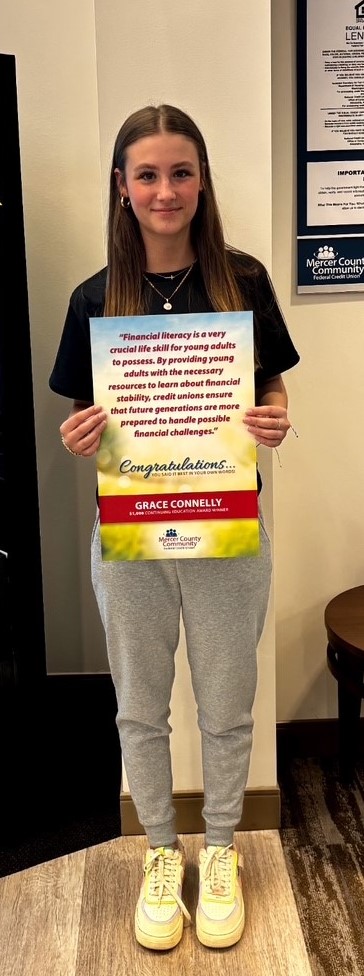

In addition, Mercer County Community FCU awarded seven Continuing Education Awards to local high school graduating seniors at the annual meeting. The following students received $1,000 scholarships:

William Beckert, Sharon High School

Grace Connelly, Sharon High School

Madeline Johnson, Titusville High School

Mia Labbiento, Sharpsville High School

Mia Sarchet, Sharpsville High School

Logan Stanford, Hickory High School

Hannah Wiesen, Hickory High School

The seventh $1,000 scholarship was given in memory of David Burich, a member of the credit union board of directors and retired teacher and coach. This special scholarship was given to a student who aspires to be a teacher. Hannah Wiesen, a senior at Hickory High School, was selected to receive this award.

Honorable mention awards in the amount of $100 each were also given to the following students: Norah Butchy, Sharon High School; Ella Lipo, Wilmington High School; Jasmine McGee, Sharon High School; Lenore McMuldren, Reynolds High School; Jonathon Stanek, Sharon High School; and Conor Tharp, Sharpsville High School.

In support of continuing education for youth in our community, the Mercer County Community FCU scholarship awards began in 2000 and has since awarded over $127,000 to area students pursuing an academic, professional, or vocational post-high school education.

Congratulations to all the award winners!

Online Banking Update

The first time you log into online banking on or after April 29th, you will be prompted to re-accept the user agreement as result of enhancements to our system. Please note the content of the agreement has not changed since you last accepted it. This update may also affect some members that have devices that are no longer compatible with the changes. We expect this to affect very few of our members but want to make sure you are informed of the changes.

Teen Student Accounts Available

Designed with students in mind, our Student Accounts are available to teens, ages 15-17 with convenient features such as:

- Checking account with no minimum balance or monthly fee

- Mobile banking app and online banking

- Debit Card available to use at ATMs or shopping

Call or visit one of our branches for more information!

Mercer County Community FCU App

Our mobile app provides members convenient access to Mercer Community Federal Credit Union’s mobile website, mobile check deposit, mobile banking, branch & contact information, help and our loan application.

Our app can be downloaded from the Google Playstore or Apple App Store. Search for Mercer County Community FCU. For assistance, contact one of our offices.